For centuries, humankind has fought wars over oil, land and faith. The wars of today and perhaps the future will be about who controls the jewels of the earth, those rare earth minerals that power our age. They are in our chips, batteries, satellites, and missiles. For many countries, these elements power the very systems that guarantee their dominance. At the center of this struggle, stands the world’s largest economies, the United States and China. How this contest unfolds will depend not on bullying, threats and blackmail but on diplomacy, tact and compromise.

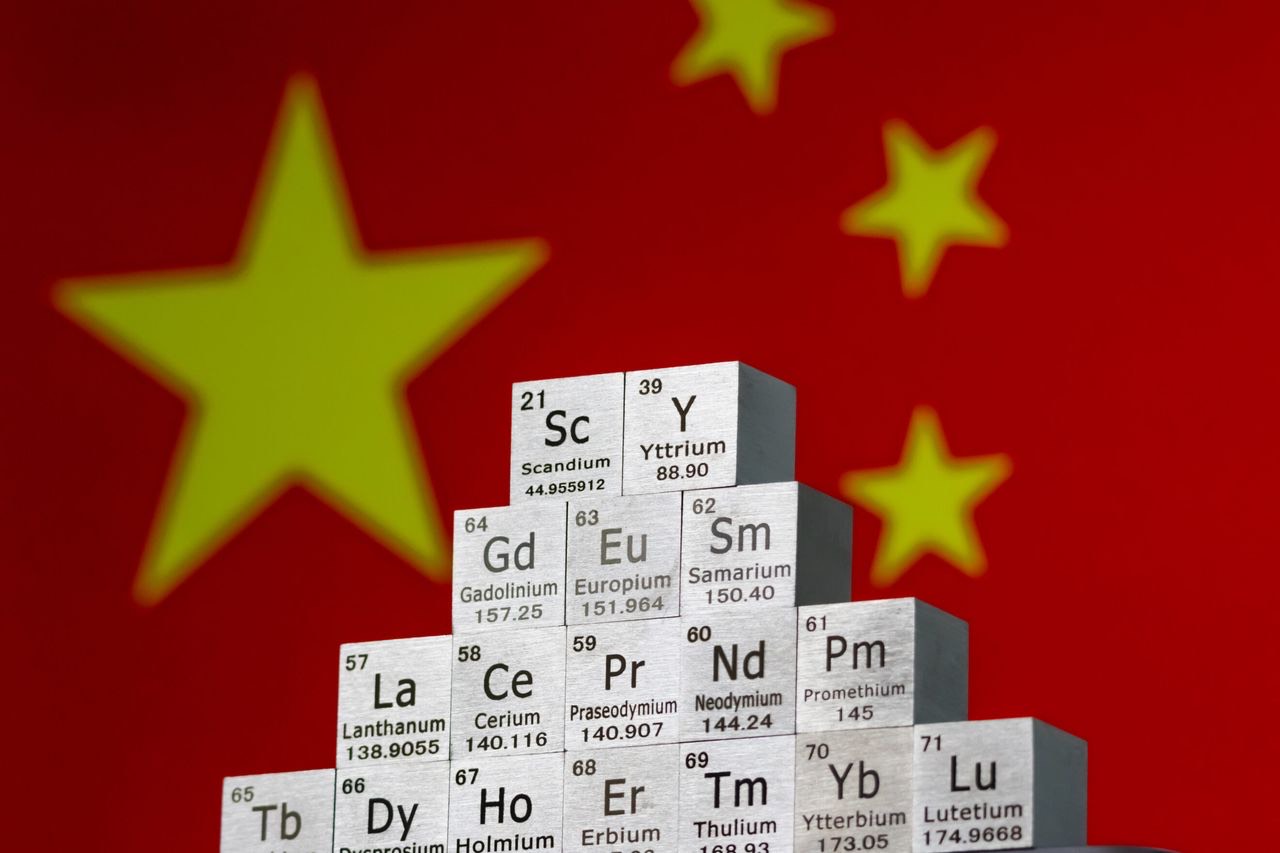

The second chapter of the U.S-China trade war kicked off with a bang. China fired a warning shot that has quite literally left the ground shaking. According to Aljazeera, China announced export controls on five more rare-earth metals- Holmium, erbium, thulium, europium and ytterbium adding to earlier restrictions on samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. Alongside these, China also restricted the export of specialist technological equipment used to refine rare earth metals. Foreign entities will now have to obtain special government approvals if they wish to export any material that contain at least 0.1 percent heavy rare earth metals from China.

As expected, the move left Washington fuming. Donald Trump took to the socials to vent his frustration, threatening 100% tariffs on Chinese exports and new export controls on critical software. The self-styled ‘king of tariffs’ went even further by questioning the importance of his highly anticipated meeting with President Xi during the Asian Pacific Economic Cooperation Summit (APEC) in South Korea later this month. Global markets and policy makers are again on tenterhooks, bracing for another phase of the largely damaging trade war between the world’s largest economies.

In this fog of trade-war, it is important to separate facts from fiction. Despite the supposed truce between both countries, the United States has continued to blacklist Chinese firms and impose port fees on china-linked ships. The Trump administration has not shied away from referring to China as an enemy and demonizing it at every turn. Washington’s long-term objective is clear: to contain China and isolate it for the mere ‘crime’ of being too good a competitor. The U.S. cites its ‘national interests’ as justification for its actions against Beijing, half a world away. However, the question practically asks itself, if Washington can behave this way in the name of national security, what stops China from doing the same?

The export controls on rare earth minerals are an assertion of sovereignty and safeguarding national interests. Rare earth metals are not run-of-the mill goods of trade. They are the hidden backbone of advanced weaponry. These elements are critical in the production of fighter jets, Submarines, radar systems, missiles, drones, smart bombs and AI driven military systems. If anything, China has a stronger moral case: Its restrictions include exemptions for humanitarian and emergency uses such as medical and disaster relief.

The world must root for the Trump-Xi summit in South Korea to take place. The two most powerful leaders in the world need to sit down and talk. Dialogue, not ultimatums will resolve this contest. The United States should approach the table with some humility and respect for China’s national interests, something Beijing has consistently emphasized. For constructive international relations, respect for sovereignty, and the legitimate security concerns of other nations is an essential prerequisite. Trump’s approach of strong-arming countries into ‘deals’ will not work with China. Compromise grounded in mutual benefit is the only path forward. The President of the United States must have learned from his attempts to force India away from Russian oil that it simply does not work that way anymore. Instead, India has grown closer to China, a development that strengthens global stability but complicates Washington’s foreign policy objectives in the Indo-pacific.

China will approach this summit from a position of strength. It controls 90% of the world’s rare earth elements, dominates lithium-ion battery supply chains, and controls a vast network of mineral processing facilities that the West lacks both the capacity and the political will to replicate in the short term. Most importantly, Beijing has shown a willingness to engage in dialogue and compromise. The United States must come to terms with the fact that China is now a pace setter, a capable competitor unafraid to defend its national interests.

Perhaps the most significant outcome for the Global South and the rest of the world would be Washington’s recognition that Beijing has the potential to become an indispensable partner. This would open opportunities, to borrow from Trump’s signature turn of phrase “the likes of which the world has never seen before.” Now is a time for diplomacy and not war, for dialogue and not threats.

The Writer is a Senior Research Fellow at DWC.