THE AID TO AID US IN DOING AWAY WITH AID

By Salim Abila Asuman

The nation breathes in a symphony of fiscal toxins, with each exhale dealing a crushing blow to its fragile economy. Loans of all kinds now sit on its people’s shoulders, tasked with bearing the weight of unjustified financial obligations.

National debts, the financial chains binding governments come in various haunting forms and they are the following;

Internal Debts: This is a specter lurking within borders, internal debts arises when a government borrows from its citizens or domestic institutions. This debt, though seemingly closer to home, can still cast a long and dark shadow on the economy.

External Debt: This one is a phantom from beyond borders, external debt materializes when a nation borrows from foreign entities or international institutions. The chains of external debt can tighten as global economic tides shift, rendering nations vulnerable to external forces.

Unfunded Liabilities: These are a silent menace, unfunded liabilities represent promises made by governments for future payments, such as pensions and social security. As these promises accumulate, they form an invisible debt, haunting fiscal planners with the fear of impending obligations.

Contingent Liabilities: Is a lurking uncertainty, contingent liabilities emerge from potential future events that may lead to financial obligations for the government. These debts, like ghost in the shadows may materialize unexpectedly, casting doubt on the nation’s financial stability.

The authority to negotiate any of the aforementioned loans is laid at the door of the government, and with it handicapped, the pendulum swings in favor of corporate lenders. The truth is plainly that governments come and go, leaving the people to bear the burden of irresponsible state actions, and this weave needlepoints of emotions that touch the very soul of an originally Ugandan that bears the burden of repaying his nations debts.

The multifaceted consequences of national debt on a nation’s economy are also explored here, this is done through investigating the intricate interplay of economic indicators, government policies, and global financial dynamics.

On interests and budget allocation, high national debt can lead to increased interest payments, limiting funds available for other budgetary priorities like infrastructure, education, and healthcare.

The crowding-out effect, is also as a result of increased government borrowing, it reduces private sector investment and borrowing, thus hindering economic growth by increasing loan costs.

Additionally, the competition for funds in the credit market can limit the resources available for private enterprises, contributing to a crowding-out effect.

High national debt also limits fiscal flexibility, and as a result limiting the government’s ability to respond to economic challenges, allocate discretionary spending, and to invest in long-term economic development.

Amidst all the above there is aid to aid us in doing away with aid; this is the concessional loans from China. Unlike commercial loans, concessional loans come with more favorable terms.

These financial aids are often extended by governments or international institutions, featuring lower interest rates, extended repayment periods, and greater flexibility. And the intention is to support the economic development of recipient nations without burdening them with stringent conditions associated with commercial borrowing.

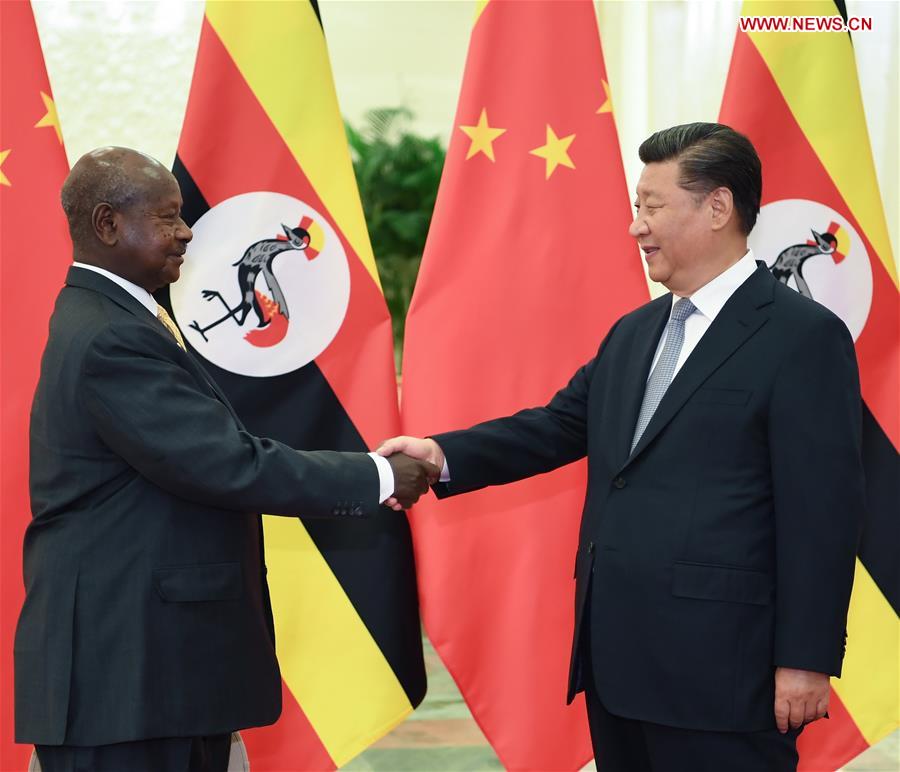

China’s involvement in Africa particularly through concessional loans, has played a pivotal role in financing various infrastructure projects and initiatives across the African continent.

The terms of concessional loans from China are designed to be more favorable than of commercial loans, and these terms include lower interest rates, longer repayment periods, and increased flexibility.

This nature of this loan is meant to alleviate financial burdens on African nations, allowing them to focus on development without the immediate strain of high-interest payments.

In recent years, Uganda has benefited from Chinese concessional loans, to boost infrastructural development, showcasing the practical benefits of collaboration between the two nations. Here are a few examples:

Expansion of Entebbe International Airport: China Exim Bank’s concessional loans have significantly improved Uganda’s Entebbe International Airport, increasing capacity, updating facilities, and operational efficiency, thereby enhancing the country’s international stature and global connectivity.

Karuma Hydropower Project: China’s financial support significantly contributed to Uganda’s Karuma Hydropower Project, a 600-megawatt hydroelectric plant on the Nile River, promoting sustainable electricity generation and a more energy-secure future.

The Isimba Hydropower Project, funded by Chinese concessions, significantly boosts Uganda’s electricity generation capacity, providing reliable power to urban and rural areas and boosting economic activity.

The Kampala-Entebbe Expressway: Funded by China, it has significantly improved Uganda’s transportation infrastructure, alleviating traffic congestion and boosting economic activity by facilitating quick access between Kampala and Entebbe International Airport.

The Source of the Nile Bridge is another Chinese concessional loan-supported structure in Jinja, that has significantly improved regional connectivity, boosted trade and tourism, and showcased Uganda’s commitment to sustainable development.

In the complex landscape of interstate relationship, concessional loans also play an important role in strengthening interstate partnerships, establishing them as a potent tool for boosting collaboration and mutual development.

Concessional loans stimulate economic growth in recipient countries by providing financial assistance on advantageous terms to infrastructure projects, industries, and other critical sectors.

This economic boost benefits not just the recipient state, but also has a knock-on effect, encouraging regional stability and collaboration.

Negotiating and implementing concessional loans often involve mutual development goals, this motivates governments to work on long-term projects, nurturing unity and purpose, and forming links beyond economic transactions.

Infrastructure projects backed by concessional loans create job possibilities, the interchange of talents and expertise during project implementation strengthens inter-state relationships.

Loans at concessions include flexible terms that reduce financial risks and promote shared achievement to the receiving state, that in return foster confidence and collaboration which are crucial for interstate ties development.

Diplomatic cooperation is crucial for concessional loan negotiation and management, fostering discourse, compromise, and problem-solving, laying the groundwork for future diplomatic partnerships and communication channels.

Most important concessional loans are a potential antidote to corruption in nations plagued by notoriety for malfeasance. This financial instrument is accompanied by stringent conditions and transparency mandates, it brings with it a web of oversight mechanisms, audits, and accountability measures.

This heightened scrutiny creates a transparent landscape, significantly reducing the loopholes and opportunities for corruption.

These loans are inherently tied to development projects and public welfare initiatives, this strategic alignment ensures that the funds injected into the nation are directed towards projects with a tangible societal impact.

By prioritizing the common good, concessional loans minimize the risk of funds being drawn off for personal gain, nurturing a culture of responsible financial management and accountability.

In essence, these loans become not just a financial lifeline but a catalyst for transformative change, challenging the entrenched patterns of corruption that have plagued this nation for far too long.

In the inhale of an assortment of financially crippling poisons, this nation has absorbed every toxic offering, each delivering a devastating blow to the fragile economy. This relentless assault has heaped an undue burden upon the shoulders of its citizens, compelling them to bear the weight of unnecessary financial obligations. Amidst this dreadful set-up, the beacon of hope flickers in the form of concessional loans—the only aid capable of assisting us in breaking free from the chains of perpetual financial strain.

The author is a junior research fellow at the Sino-Uganda Research Centre.

related publications

DWC

Development Watch Centre

Kampala - Uganda

ADDRESS

Plot 212, RTG Plaza,3rd Floor, Office Number C7 - Hoima Road, Rubaga

CONTACT

+256 703 380252

info@dwcug.org